Table of Content

The bank will need to see copies of financials and other documents. Your credit score can have an impact not only on your ability to get a mortgage, but also on the loan’s rate and terms. Mortgage lenders consider your score, alongside other factors like employment, income and debt, to determine whether you can realistically afford the home you want. If you’d rather not take on a loan that’s secured by your home, consider a personal loan instead. Unsecured personal loans allow you to borrow money without collateral.

You may be able to get a home equity loan on your co-op but it may not be as easy as borrowing against a single-family home, townhouse, or condominium. This is because, unlike those traditional housing options, a co-op isn’t real property, which complicates matters. Bankrate is compensated in exchange for featured placement of sponsored products and services, or your clicking on links posted on this website. This compensation may impact how, where and in what order products appear. Bankrate.com does not include all companies or all available products. Americans typically begin borrowing in young adulthood as they face major expenses like housing and education at a lower income level.

TAX CENTER

Users highly praise the bank and say it’s best for customer support. On the Better Business Bureau website, it received the highest rating for providing customers with helpful tools and a customer support team that answers all questions quickly. You also have to pay an origination fee of $295 if you get a HELOAN or $50 a year if you get a HELOC.

Selling your car could put thousands of dollars in your pocket to either pay for your mobile home repairs or reduce your total loan amount. But do the math and make sure your near-term windfall won’t cost you more down the road. That said, there are places where you can potentially secure a loan for your mobile home, including credit unions, banks, or private mortgage lenders. A home equity loan can be an easy way to borrow money at a relatively low interest rate, but in the process, you are risking your home.

Thinking about buying but not sure where to begin? Start with our affordability calculator.

Our editorial team does not receive direct compensation from our advertisers. For both its HELoans and HELOCs, Prosper charges an origination fee of up to $1,495 in some states. Although prepayment fees are common among lenders when it comes to HELOCs, with Prosper, there's no prepayment penalty if you pay off your account in full and close your line of credit early.

Your financial situation is unique and the products and services we review may not be right for your circumstances. We do not offer financial advice, advisory or brokerage services, nor do we recommend or advise individuals or to buy or sell particular stocks or securities. Performance information may have changed since the time of publication. Community banks and credit unions might have more flexibility when it comes to their underwriting standards than big banks do especially if you are already a customer there. They also have to compete harder for business, and may be willing to take on riskier loans.

Home-equity Loans Are Available to Co-op Shareholders

You can start by pulling a free copy of your credit reports from each of the major bureaus at AnnualCreditReport.com and review them for any issues. For example, you might find an error, which can drag down your score. If you do find a mistake, be sure to dispute it with the bureau that’s reporting it, as it can take weeks to fix on your credit report. With equity fundings, you use the value of the house and location the residence as collateral for the financing.

Submit all the documentation regarding the co-op the loan officer requests. “We’ve seen co-op owners take out HELOCs to pay assessments, as well as to renovate or consolidate credit card debt,” Baldwin says. “You borrow what you need, when you need it, and pay it back over time,” she says. A Home Equity Loan- lets you borrow a fixed amount, secured by the equity in your home, and receive your money in one lump sum. Alternatively, depending on your age and where you live, a reverse mortgage might be an option. Starting May 30, 2022, New York state co-op owners age 62 or older can get a reverse mortgage (technically, a “reverse co-operative apartment unit loan”).

There can be significant differences in the amount of fees that are charged, so be sure that you are getting the best possible deal. “As interest rates rise, you may not want to refinance to take cash out,” says Brittney Baldwin, vice president and loan officer at National Cooperative Bank. A home equity loan allows you to leave your current first mortgage in place and take out a fixed-rate second mortgage in a lump sum. A Home Equity Line of Credit is a revolving credit that allows you to borrow money as you need it and pay it back over time, with your home as collateral.

The home equity loan is a great way to lock in your monthly payments,” Baldwin says. Home equity loans are available from many of the same lenders that issue regular mortgages. If you belong to a credit union, it will most likely offer a home equity loan option with highly competitive rates and fees. In addition to credit unions, many banks offer low- or no-fee home equity loans. You will need to provide proof of income, proof of assets and proof of any financial liabilities.

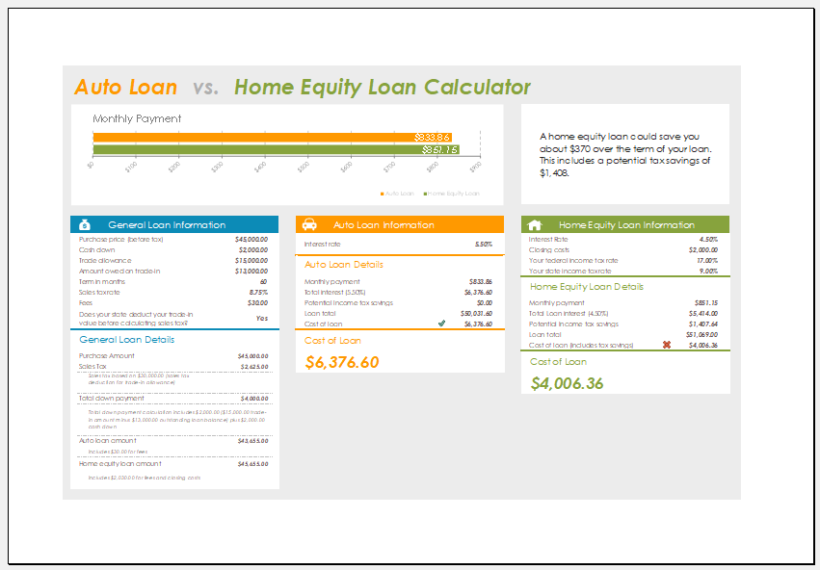

But with rates inching back up, taking cash out when you refinance means your monthly payments will be higher—on top of the $2,000 to $3,000 it costs to refinance. Still, if you own your co-op apartment outright, Bank of America says you can borrow up to 80% of its value, with 90% of that having a fixed interest rate and the other 10% having a variable one. You may then take your entire credit amount at closing and start repaying it with no prepayment penalty, which is just like getting a lump sum from a home equity loan. However, Bank of America notes that the loan is not an easy one to get. It requires "a lot of paperwork," as part of the underwriting process involves looking into how successfully the particular co-op operates.

Your lender pays you a lump sum, which you repay with fixed interest over a specified loan term. The average credit score for first-time homebuyers is 746, according to a recent report from FannieMae. Many lenders can turn part or all of a HELOC into a regular fixed-rate loan if the borrower wishes. It is best not to use this type of loan if you plan to move in the next few years. It’s important to understand that you’re borrowing money based on the value of your home in the market, and it could drop by the day you want to sell it. For many couples, the wedding is the most important celebration of their lives, after which they want to spend some time on a wedding trip.

Before pursuing loans, compare options to find the most favorable, and even "consider whether it’s better to hold off on improvements until you can cover them in cash," Harris said. A loan modification changes the original terms of your mortgage, often due to a long-term or permanent hardship. If you’re using a home equity loan to “buy, build, or substantially improve” your property, the interest you pay may be tax deductible.

No comments:

Post a Comment